INCOME TAX

When will I get my P60 Form for 2018/19?

P60 Forms, the end of year tax statements, will be issued in the first week of May. These will be available on HR Connect in the Pay & Benefits section, the same place you view your monthly payslips.

Can my P60 Form be sent to me by e-mail?

Yes. If you wish to receive an electronic version of your P60 Form via e-mail, ensure your e-preferences on HR Connect are correct by 30 April.

How do I check my e-Preferences are correct?

Here’s how to ensure you are sent a P60 Form (and monthly payslips) by e-mail:

- Log into HR Connect Self Service

- Click on the little face icon in the top right-hand corner of screen

- Click on E-Form Preferences

- Tick ‘E-mail Payslip’ box (if not already ticked)

- Enter your personal e-mail address (if not already populated)

- Enter your password, and then confirm password (if not already populated)

- Tick ‘E-mail P60’ box (if not already ticked)

- Tick ‘Use the same password for E-mail and P60’ box (if not already ticked)

- Click on the ‘Save’ button

Can my P60 Form be sent to me on paper?

To improve efficiency, we only issue electronic P60 Forms. You can print this yourself from the PDF version or through HR Connect. Do not tick the ‘Print P60’ box on HR Connect as we are unable to provided printed P60s.

Why is the Taxable Pay figure on my P60 Form less than what I have earned for the year?

The P60 Form shows Taxable Pay and not total Gross Pay, as this is the earnings figure that is reportable to HMRC.

What is the difference between Taxable Pay and Gross Pay?

Taxable Pay is your total Gross Pay, less any deductions that attract tax relief – including pension contributions, salary sacrifice deductions, and Give As You Earn contributions.

What will my new tax code be in the 2019/20 tax year?

Tax codes are dependent on an individual’s personal tax, however the standard personal allowance (Scottish) tax code for the new tax year has increased from S1185L to S1250L. This is a 65 point increase, which gives you approximately an additional £650 over the year, before you start paying Income Tax.

For many employees their tax code in April will have increased by 65 points, compared to their tax code in March. For other employees, due to their own personal tax situation, their tax code may have increased or decreased by a different amount. These employees should have received notification of their new tax code from HMRC.

I think that my tax code is incorrect. What should I do?

We action all tax codes notifications that we receive from HMRC on a monthly basis. If you believe your tax code on your April payslip is incorrect, contact HMRC on 0300 200 3300. You will need to quote your name, your National Insurance number and the University’s Tax Reference – 961/7027438.

LOTHIAN PENSION SCHEME

Why has my pension contribution changed in April?

All employees have their pension contribution banding reassessed on 1 April each year. While most employees will continue to pay the same percentage in contributions in April as they did in March, some employees will see an increase, and others will have a decrease, due to contractual changes.

How do I check if I am paying the correct percentage?

The banding is based on your actual contractual earnings, which is your full-time or part-time salary, plus any contractual allowances (if applicable). For employees with more than one position at the University, the assessment is carried-out on the earnings of each individual position, and not on your overall employment earnings with the University.

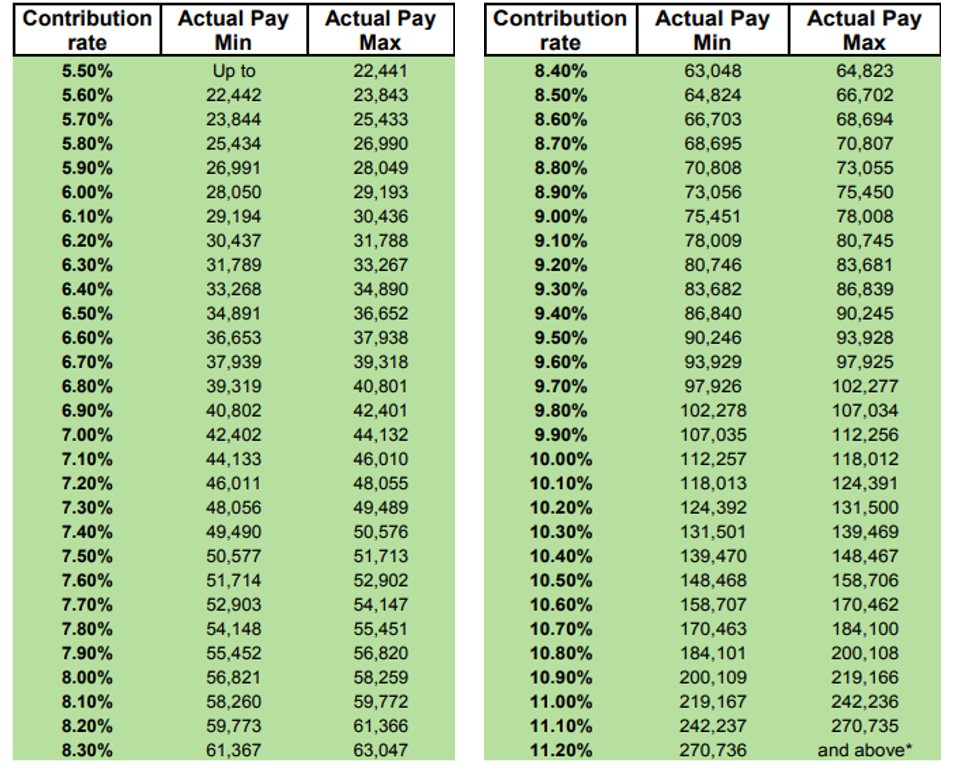

This is the earnings table for 2019/20. The University makes contributions of 20.40% into your pension fund.

I think that my pension contribution percentage is incorrect. What should I do?

If you believe that your contribution as detailed on your April payslip is not correct, email payroll@napier.ac.uk.

SCOTTISH TEACHERS’ PENSION SCHEME

Does this same banding reassessment exercise also occur for the Scottish Teachers’ Pension Scheme?

No. Contribution bandings are assessed on a monthly basis for this scheme, so there is no material change on the 1 April. The University makes contributions of 17.20% to your pension fund, increasing to 23.00% from 1 September 2019.